rhode island tax rates 2021

The tax breakdown can be found on the Rhode Island Department of Revenue website. Exact tax amount may vary for different items.

Tax rate of 599 on taxable income over.

. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in. 2989 - two to five family residences 3243 - commercial I and II industrial commind. In addition to the sales tax there is also a 6 hotel tax on the rental of rooms in hotels.

R I State And Local Income Tax Per Capita 2nd Lowest In New England The table below shows the income tax rates in Rhode. The Rhode Island estate tax is not portable between spouses. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax of.

39 rows Central Falls has a property tax rate of 2376. The 2021 SUI tax rates were assigned based on Rate Schedule H with rates from ranging from 099 to 959 up from 069 to 919 for 2020 on Rate Schedule F. 4 West Warwick - Real Property taxed at four different rates.

The SUI taxable wage. West Warwick taxes real property at four distinct rates. Tax rate of 375 on the first 68200 of taxable income.

Woonsocket has a property tax rate of 2375. Click to share on facebook linkedIn Icon. Learn how Papaya can help you comply with local labor laws.

Effective January 1 2021 the Unemployment. Click to share on twitter facebook icon. Ad One platform for all your HR payroll EOR contractors needs.

The state does tax Social Security benefits. Book a demo today. The sales tax is imposed upon the retailer at the rate of 7 of the gross receipts from taxable sales.

Find your income exemptions. Free Newsletter Sign Up. Learn how Papaya can help you comply with local labor laws.

Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Click to share on email twitter icon. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

The Department of Labor and Training DLT today announced next years rates for the Unemployment Insurance UI program. Book a demo today. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum.

Rhode Islands interest rate for tax underpayments is 18 for 2021 unchanged from 2020 the state taxation division said in a notice Oct. Rhode Island Income Tax Calculator 2021. Any income over 150550 would be taxes at.

The rate so set will be in effect for the calendar year 2021. Besides the state income tax The Ocean State. The average effective property tax rate in Rhode Island is the 10th-highest in the country though.

Share this story email icon. Rhode Island uses a progressive tax system with three. Rhode Island has a.

Groceries clothing and prescription drugs are. Find your pretax deductions including 401K flexible account. Tax rate of 475 on taxable income between 68201 and 155050.

Rhode Island Estate Tax for Married Couples. The base state sales tax rate in Rhode Island is 7. Ad One platform for all your HR payroll EOR contractors needs.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. This means that when both members of a married couple die only. Rhode Island has 3 tax rates.

Local tax rates in Rhode Island range from 700 making the sales tax range in Rhode Island 700. Rhode Island also has a 700 percent corporate income tax rate. Your average tax rate is 1198 and your.

Overall state tax rates range from 0 to more than 13 as of 2021. The rates range from 375 to 599. 3470 apartments 6 units.

Income tax brackets are required state taxes in. Enter your financial details to. Find your Rhode Island combined.

3243 combination commercial I commercial II industrial commercial condo commind. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

Rhode Island Key Performance Indicator Briefing For Q4 2021 Ri S Post Pandemic Economy Grows But Still Lags The Nation In Recovering Jobs Rhode Island Public Expenditure Council

2022 Capital Gains Tax Rates By State Smartasset

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

Sales Tax By State Is Saas Taxable Taxjar

Rhode Island Sales Tax Small Business Guide Truic

Top States For Business 2021 Rhode Island

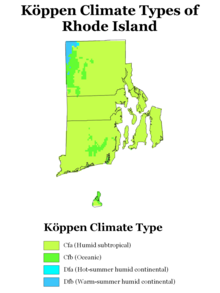

Map Of Rhode Island Property Tax Rates For All Towns

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

General Sales Taxes And Gross Receipts Taxes Urban Institute

Rhode Island Income Tax Brackets 2020

State Sales Tax Rates Sales Tax Institute

Rhode Island Cannabis Legalization Bill Includes 20 Tax Rate Ganjapreneur

States With The Highest Lowest Tax Rates

Ri Food Bank Status Report On Hunger Rhode Island Community Food Bank

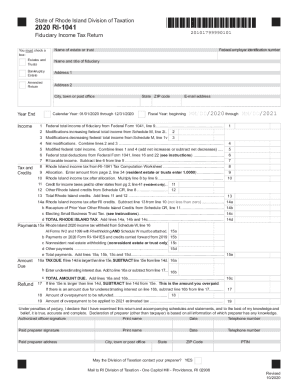

Fiduciary Income Tax Forms Rhode Island Division Of Taxation Fill Out And Sign Printable Pdf Template Signnow

Ri Kpi Briefing For Q2 2022 Rhode Island Experiences Employment Gains But Still Lags Nation In Recovery Of Jobs Lost During Pandemic Rhode Island Public Expenditure Council

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns